In Holland, prices include a value-added tax or VAT that is 21 percent. This is like a sales tax, except that it’s included in the price you pay instead of being added at the cash register.

If you are a customer from a non-EU country, like nowadays the United Kingdom;-), you can claim a VAT refund. De Vakantiefietser will help you to get a refund for a purchase of a bicycle and your outdoor equipment. There are several ways:

1. Directly from De Vakantiefietser (best choice).

Request in our shop a bill with VAT on it. Have this bill stamped by a customs official when you leave Amsterdam Schiphol Airport and leave the European Union. Then you mail the original stamped bill to us. We will deposit the full ammount on your bankaccount.

Also at other EU airports you can get this stamp at the customs. But you have to do it before you check in your bike and/or equipment!

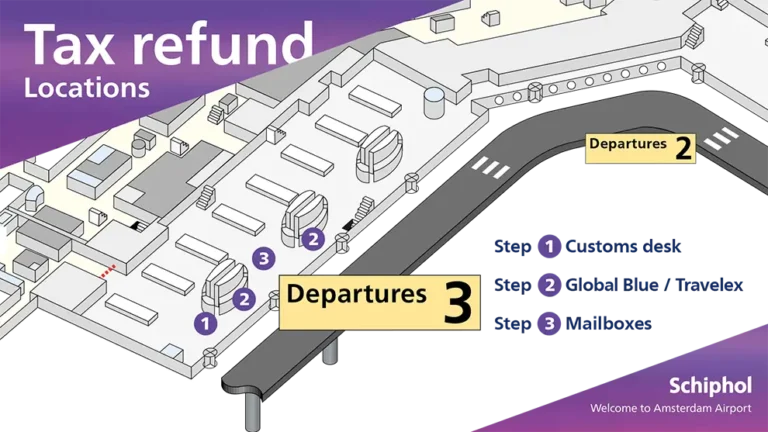

At Schiphol Airport the customs is ein Darture Hall 3, and is signposted with: Tax Free Validation.

2. VATFree:

This is easier for you if you have a lot of bills from all your purchases:-)

Ask for a receipt with VAT and your name on it from all the shops and De Vakantiefietser. Retain the purchase receipt, get a stamp at customs and drop it off at the service desk of VATFree at Schiphol Airport in Departure Hall 3. You will get your refund minus a small service fee (1 to 5 percent) on your bank account, credit card or paypal account.

The advantage for you using VATfree is that you do not have to send us the original bill.

You read more about VATfree on their website.

3. When we send the bike or when you have the bike picked up.

We can send the bike (quite expensive) or you can have the bike picked up. When we have proof that the bike is exported out of the EU we will transfer the VAT to your bankaccount

Payment options if you buy a bike or equipment in our shop:

If you choose to buy a bicycle at De Vakantiefietser, payments can be made in several ways:

1. Cash: There are various ATM’s near, serving Visa and Mastercard. Watch out for charges and additional fees.

2. Bank Transfer: Transfer the money to us and pick up the bicycle when it is ready.

Banking details: SWIFT/BIC=ABNANL2A,

Bank accountnumber/IBAN=NL11ABN0516187317

3. PayPal: Transfer it to eric@vakantiefietser.nl. But you have to add 3%.

4. Creditcard: Creditcards are not very common in the Netherlands because we have to pay a high percentage. That is why we add 2%.

Small print:

– Officially you have to export your bicyle within three months after the date of purchase. When you leave the EU after three months, you can pay the bill later so the date can be changed to a later date.

– The VAT transfer is for new bicycles and not for second hand bicycles.

– Make a brief testride before we pack it in a box. So when you import it into your own country, you don’t have to pay import tax, because it is now a second hand bike:-)